Tuition fees

- covered up to $6,000 per study period if applicable.

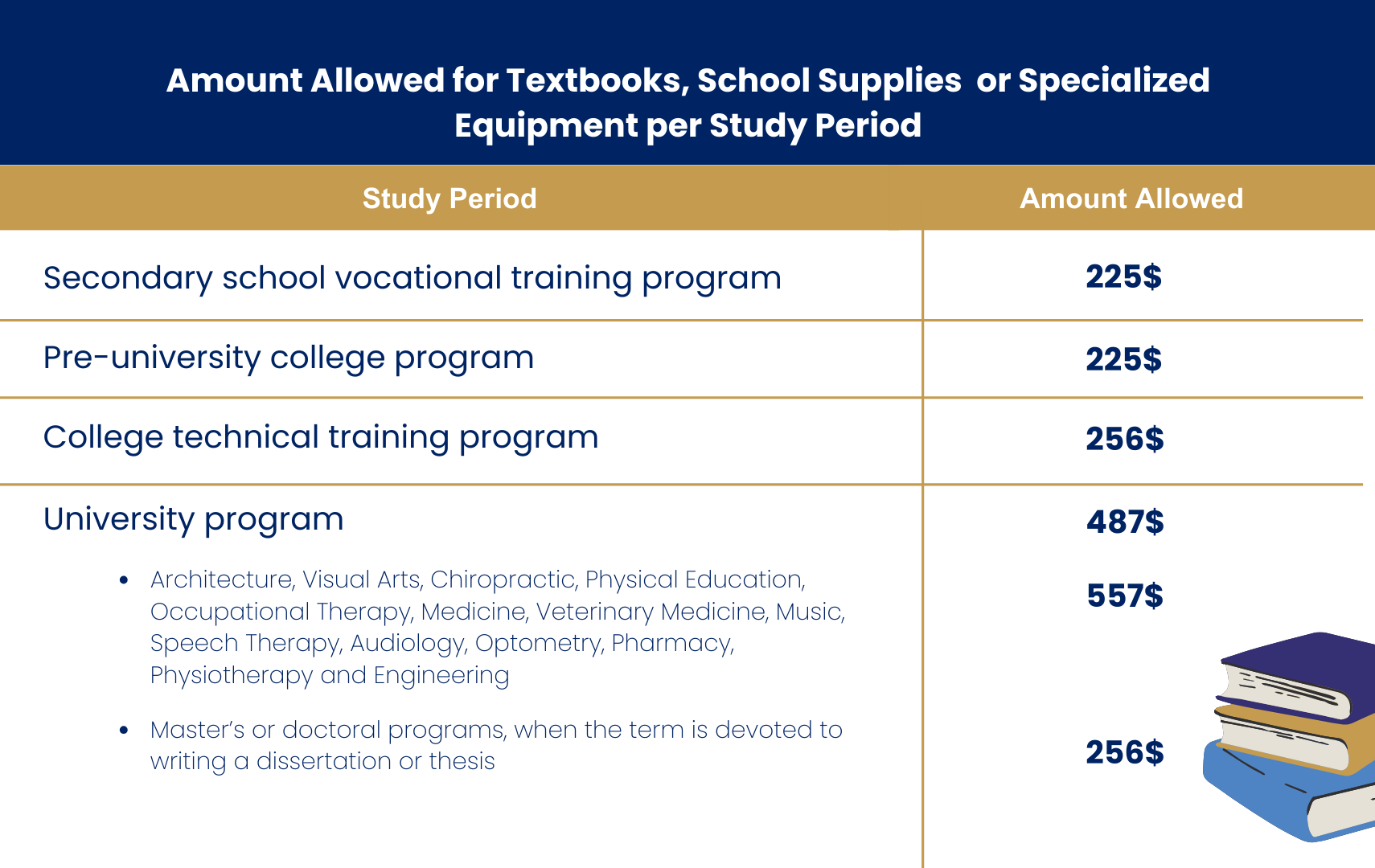

Allowances for training support materials

- For example, the purchase of a computer ;

- $500 loan per study period ;

- This request is made via the form :

1012 - Déclaration de changement 2024-2025.

Living expenses, which include accommodation, food, personal expenses and transport

- Up to $632 for a person living with his or her parents;

- Up to $1348 for a person living away from home.

Child care costs

- $196 per month of education for each child.

Children's living expenses

- $302 per month for each child.

Intership fees

- These fees apply, for example, if you have to stay in a place other than your usual residence during your internship ;

- $575 per month up to maximum of $2678 per year.

Costs related to the city, regions and so-called peripheral RCMs

- Is the transport service between your parent's home and your school non-existent or inadequate ?

- $88 per month of study to a maximum of $707 per year.

Expenses related to the purchase of visual orthotics

- Up to $224 per person recognized in the month of purchase over a period of 2 consecutive years.

Expenses related to the purchase of medication or chiropractic care

- Only the portion of exepnses not covered by RAMQ or an insurance company will be taken into account ;

- Monthly fees exceeding $16 will be taken into account at the time of declaration, provided they apply to you, your children or your spouse's children.